We asked Jason Adderley of Expense Reduction Analysts to share his thoughts on driving your law firm value before an M&A sale. In this first part of a four part series, Jason explores how cost optimisation could become a force multiplier to enhance the profitability and value of your firm.

Consolidation in the legal sector has continued apace in early 2022 with the high-profile announcements of tie-ups between Weightmans & Radcliffes LeBrasseur and Royds Withy King & Goodman Derrick.

Amongst mid-market and smaller firms even more marriages of convenience are to be expected in the coming months.

Even if you’re not thinking of selling today, cash-rich competitors or historically low borrowing costs may result in an unsolicited offer for your firm – so it’s vital to be prepared.

OVERHEADS, PROFITABILITY & VALUATION

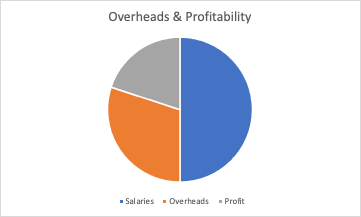

Using the example of a typical* firm’s overheads and profitability, we find proportions as follows:

Your people are your firm’s greatest cost, but also its greatest asset - and in any event in the current tight labour market any perceived ability to cut labour costs is likely to prove short lived and illusory.

So where can you look for savings that will enhance the valuation of your firm?

COST OPTIMISATION - A FORCE MULTIPLIER IN EBITDA

In military science a force multiplier refers to a factor that gives you the ability to accomplish greater feats than without it. So, it’s worth considering what force multipliers you can adopt to enhance the profitability and value of your firm - whether you’re actively selling or not.

Using our typical firm, it takes an additional £5 in revenue to generate £1 in profit.

Non-salary overheads still comprise around a third of total costs. It’s always been the case that any sustained savings found there go straight to the bottom line.

So a £50,000 saving in overhead costs is equivalent to a £250,000 increase in revenue, a £100,000 reduction equivalent to an increase in revenue of £500,000. A force multiplier indeed.

The pandemic has attached rocket boosters to agile firms’ ability and appetite to optimise costs, increase EBITDA, and ultimately the valuation of your firm. It’s also perfectly possible to reduce costs whilst at the same time enhancing the quality of services – as some of your suppliers will, or could be, a key source of innovation.

It’s crucial therefore to review supplier spend in a professional and structured manner.

Over the next series of articles we’ll explore what you should be interrogating, how to interrogate it and why it matters.

Author: Jason Adderley

Jason leads Account Management & Development in the professional services sector for ERA.

He joined ERA after a 15-year career in the commercial property development and investment industry, and works with a diverse client base comprising solicitors, actuaries, chambers, patent attorneys, accountants, surveyors, consulting engineers and recruitment consultants.

Website: https://uk.expensereduction.com